Sanford NC Housing Market Update - Is the market going to crash?

Video Transcript:

The national news headlines would have you believe that we are headed for a crash.

right? If we take a look right now at national headlines, we got these 210 bubbly housing markets could crash 25-30% high mortgage rate, tight supply.

Um, real estate market is on shaky footing. You know, these are national headlines that you're gonna see on all the major news outlets. When you take a look at the um, local headlines, we have real estate boom expected soon in sanford, right? And some of these are older, we don't have as much uh, common news in the area.

Industry experts anticipate real estate boom right behind the wolf speed deal. Right, this is in siler city, we have a lot going on here locally. Well, we really need to look at these local uh, stats to get an idea of where the market is headed in sanford. So let's take a look right, we got median sales price or average sales price in sanford month over month and we can see from january 2019, we have steadily creeped up that the trajectory is up, right? And specifically, right, since rates changed in like may and june, we had a slight dip right after that, in july when interest rates really jumped up um initially, uh and then, but even then it wasn't a huge dip and then now we have trended back up in august uh and again in september and when we look at this, these statistics from year over year stats from 2021 were up over 13% in housing values here.

Um we also like to look at the number of showings per listing. Um so right now, the amount of showings per listing rose pretty significantly declined um in the winter and then we're again declining right now as we go into the fall in the winter months, which is typically, you know, expected right less people shopping for houses. So, um all this is pretty typical.

A number of shows to pending um means, how many showings does it take on average for housing to go under contract? Um in sanford right now, um it's at 14 previously, it was 17, 21. Uh if we look at the year over year statistics, it's, you know, down from 15 to 14.

Um so houses are going under contract at about the same pace that they were this time last year and and about the same pace that they were within the last few months, not much has changed right days on market if we look at the year over year stats for days on market um in sanford, uh we have an average of 20 days on the market, that is up 53% and I'm not sure why it's taken a long time from last year when we look at that on um you know, the timeline for a month over month basis, um it is uh something that has fluctuated, but there isn't any drastic change here, right? We are experiencing this huge shift, like we are in other areas of the country.

If we take a look at the supply numbers, we went from january 2019, 3 months of supply, we dipped down around the one and under one range and we're still at only one month of supply in sanford. Right? So um these numbers just tell me that it's much business as usual right now, I will say that buyers have more options right now, which has pushed a lot of them to new construction.

Um you're competing with new construction. If you're looking at selling your house, you have a plethora of options. If you are a buyer in the market right now and you're considering new construction. Um so that has changed how hot it feels, right? How hot and how much of a frenzy people are going after the listings that do hit the market.

Another thing that people are thinking about right now um is interest rates and we'll touch on that in a second, but if we take a look at the market conditions were still very much in a seller's market, right? Um, that has not very much one month of inventory. Uh, if we look at the homes sold in sanford last month, uh nine homes were sold under asking, nine homes were sold at asking and eight homes were sold over asking right now.

This time last year, a lot of this would have been all over asking, right? This presents a unique opportunity for a seller in the market. Where the common argument before was I want to sell my house, but where will I go? I'm gonna have to over pay.

I'm gonna have to go over asking. I don't want to be homeless. All these things were common things that people said um back, uh, you know, during the frenzy right now you have the opportunity as a seller, if you work with the right agent, the right professional to end up over here in the green, the over asking on the sale of your house and over here in the pink on the under asking on the buy of your house, you get to have your cake and eat it too. Right?

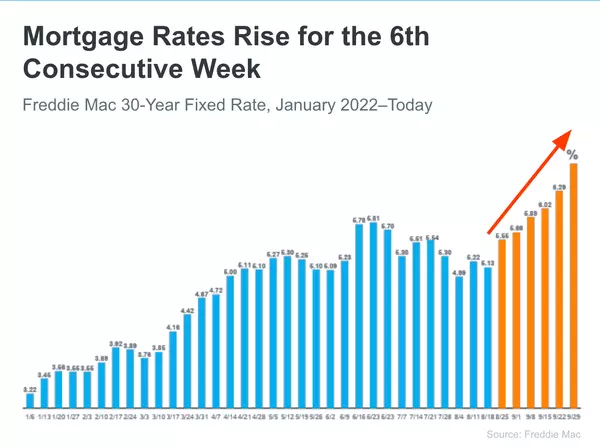

So there's not many times that you're able to capitalize on both ends and we're in one of those periods right now. So, um, the I mentioned before that one of the other things that people are thinking about right now and we couldn't really do a market update without touching on this is interest rates, right? Interest rates are causing a lot of this uncertainty in the market.

Right? And that's one reason why people are, you know, houses are taking just a little bit longer to go under contract that uh, people are gravitating towards new construction because they're offering big incentives to help you buy down the points or, you know, pay closing costs on your loans.

But interest rates right now as of october 3rd, uh, $400,000 loan amount. And I'm not quoting interest rates. I'm not a mortgage professional. I'm on google showing you the average rates across the industry, $400,000 loan amount, 5% down payment in north carolina with a 700 to 7 19 credit score, 30 year fixed is averaging 7. 2% right.

This time last year we were in the threes, maybe fours 7. 2%. Right. That's a big number. Um, on a f h a r v a loan. Those numbers are a little bit lower. Usda any of the government back loans and check this out on a 36 arm without any points or anything. 5. 75%. You can go about a point and a half lower on an arm right now and watch some of our other videos or read some of our other blog posts on where you think we, where we think rates are headed in the next six months to a year, two years that timeframe where you know, if you buy right now and you end up higher interest rate, you may be able to refinance in the future. Um and actually that's the strategy we're talking to a lot of our buyers about right now is mayor the house and date rate, right? The house is permanent, find a house that you like and then date the rate right?

Because the rate doesn't have to be permanent. You may choose to go with adjustable rate mortgage right now, an arm and lock in a rate a point and a half lower than you would on your conventional loan because you plan to re fire in the next 2 to 3 years, maybe sooner.

Right? And there are no shortage of lenders who offer incentives and programs where you can refi for a very low cost. So don't be afraid about purchasing right now because of interest rates, do what you need to to get the rate that you're comfortable with. You know, if you have to stomach a little bit of a higher payment in the short term, you know, you, you may be able to buy a house with significant equity under asking price, get the sellers to pay some closing costs.

And also because you work with a great real estate agent sell your house above market value and above asking price. Um, so don't let the interest rate stand in the way of that by the house. Get into it and if you're not happy with the interest rate, go with an arm right now and refinance in a couple of years.

So, um, that's the, you know, that's the gist of where we are at in our market right now, there's a ton of new construction inventory. A really strong strategy right now is to go under contract on new construction houses. Um, we're putting in offers under asking price on new construction homes and getting them accepted along with incentives for closing costs.

Um, so a really good strategy right now for those looking to sell but want to upgrade or sell and want to downgrade is locking that new construction home, that's a couple of months from being complete. Right, get the incentives, get the upgrades, get the closing costs, um, get a house with equity and then we'll time the sale of your house to coincide with that closing.

So if you found this useful, uh, you know, find us on youtube instagram facebook linkedin, connect with us there, hit the comment button, the subscribe button, that little bell. So you get notifications. Every time we put on a video um, drop a message in the comments below.

If you've got an opinion on where you think this market is headed or if you think I'm, I'm accurate or not accurate, I'd love to start a conversation about that. Um, so if you have any questions at all our contact information will be in the comments and we look forward to hearing from you.

That's the sanford north carolina housing market update for october 2022.