Should you sell your home in 2022 or wait until 2023? How are interest rates affecting the housing market?

It's a common question for homeowners right now.

Should you sell your home in the last few months of 2022 with interest rates at recent high levels, or should you wait until 2023?

The short answer is: it depends. If you're ready to move, you can still capitalize on record equity gains and cash in on the value in your home, while also taking advantage of a softer buyers market.

If you wait, you could potentially have a better environment for selling at some point in 2023, but that may also coincide with a tougher environment for buying a home.

It's a balancing act that we're prepared to help you navigate with local, Sanford, Lillington and area specific knowledge on the real estate market.

Let's set the stage:

First off, let's set the stage for where the market is at currently. Here's what we know:

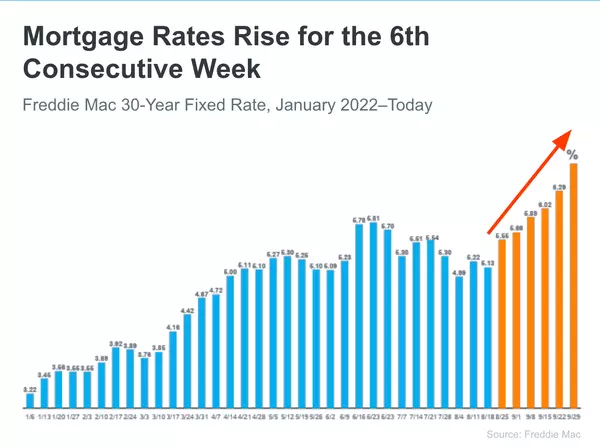

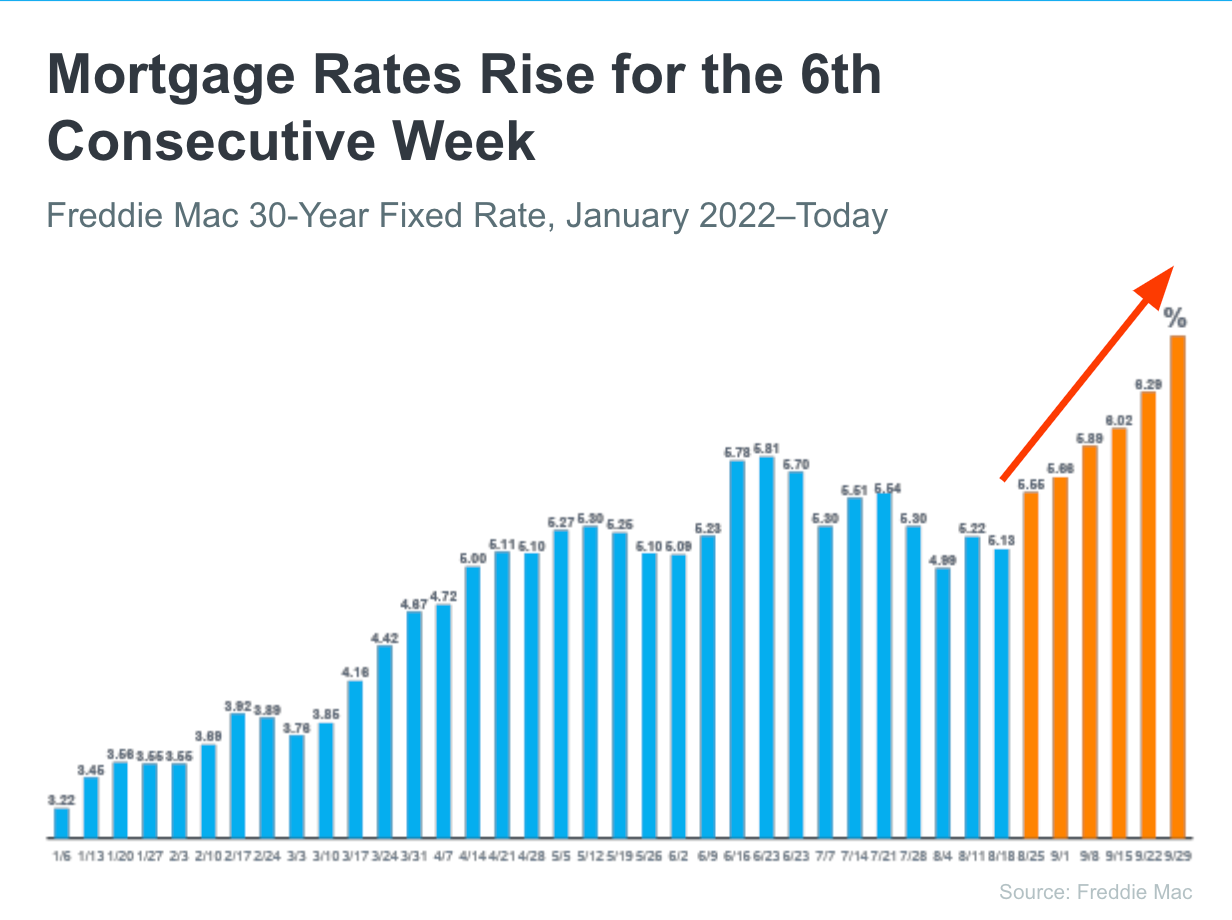

- Interest rates have risen pretty dramatically over the last year.

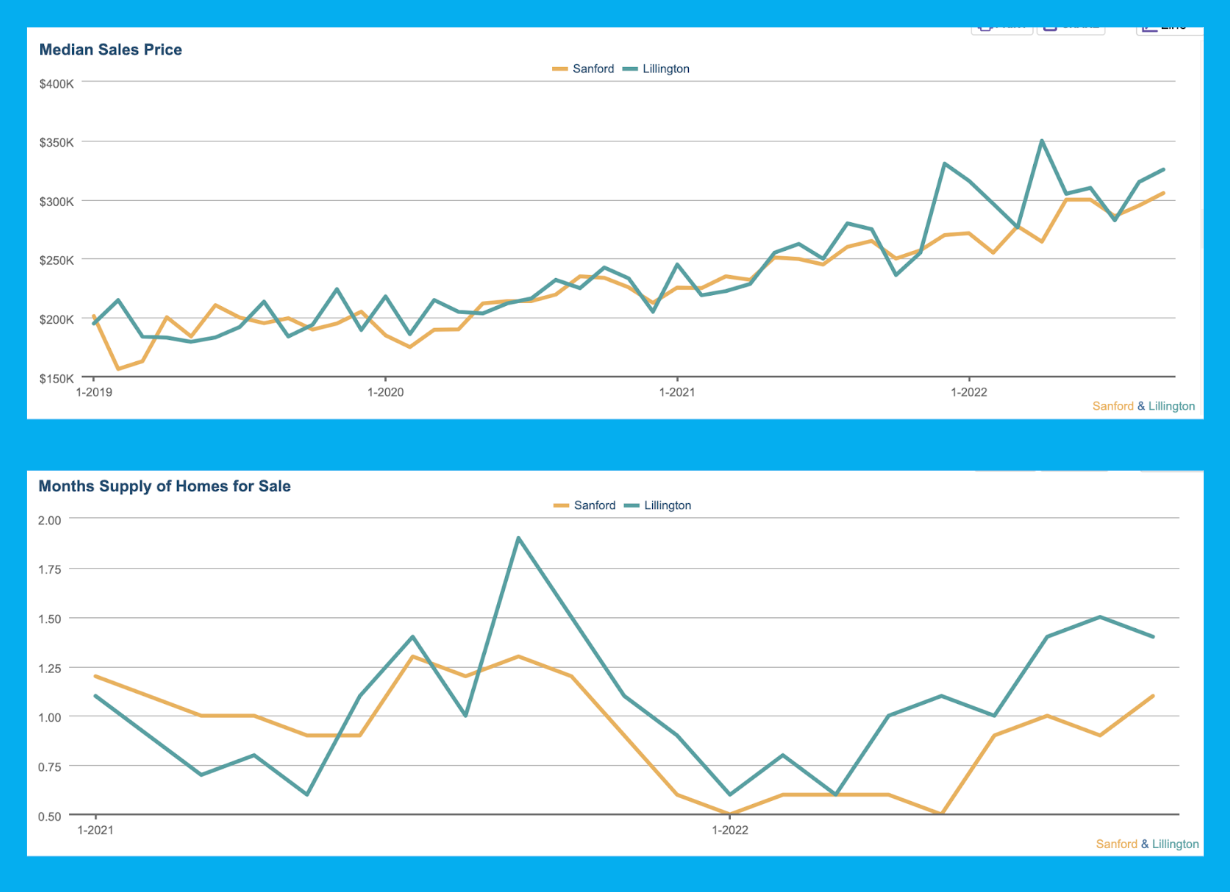

- The market still hasn't crashed, but it has slowed down a bit. About 1/3 of the homes sold in Sanford and Lillington during the month of September closed above the asking price, telling us there is still opportunity to capitalize on.

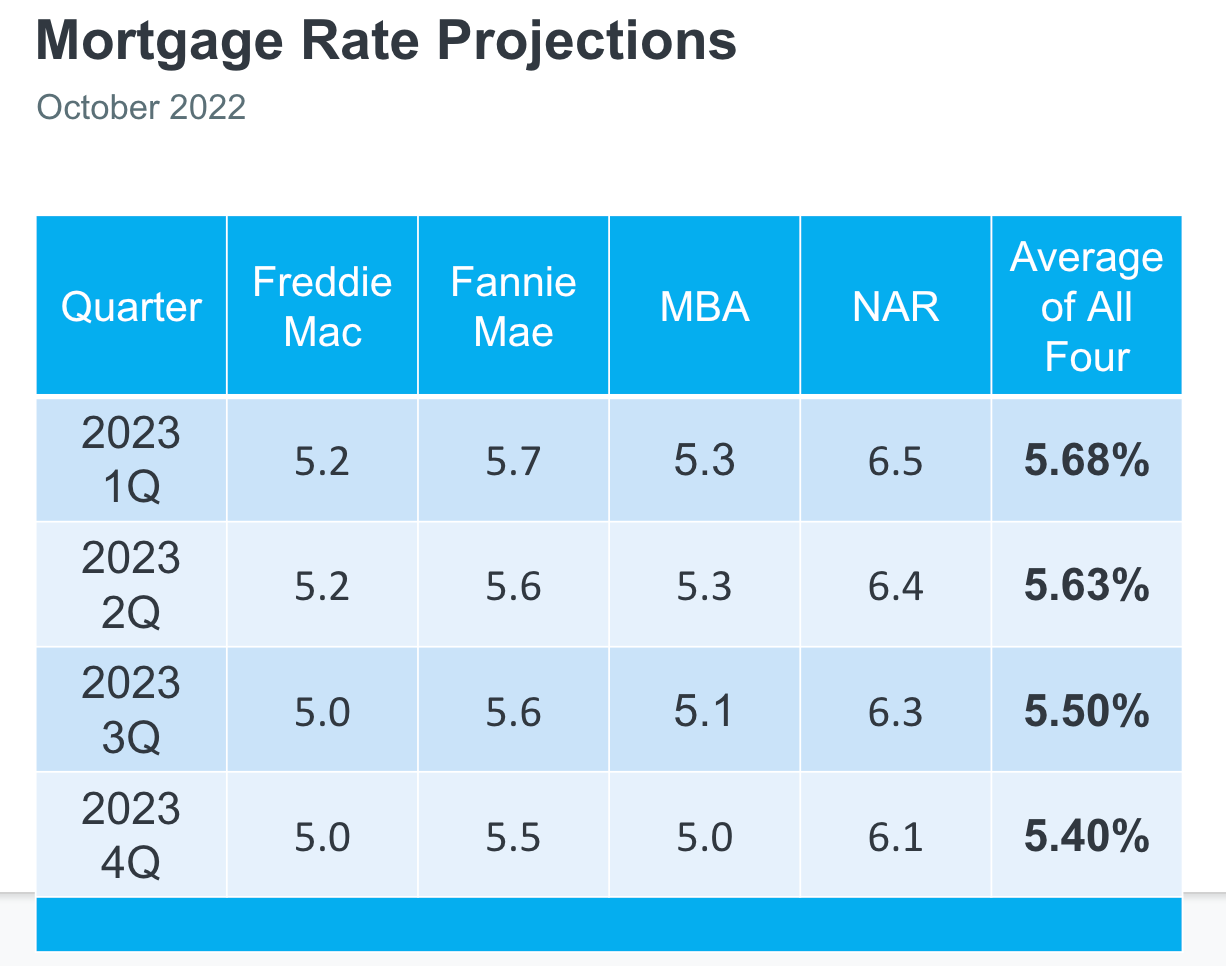

- Mortgage Rates are expected to come back down again in 2023. When? I don't have a crystal ball and no one else does either, but most of the experts agree it's coming down sometime again in 2023.

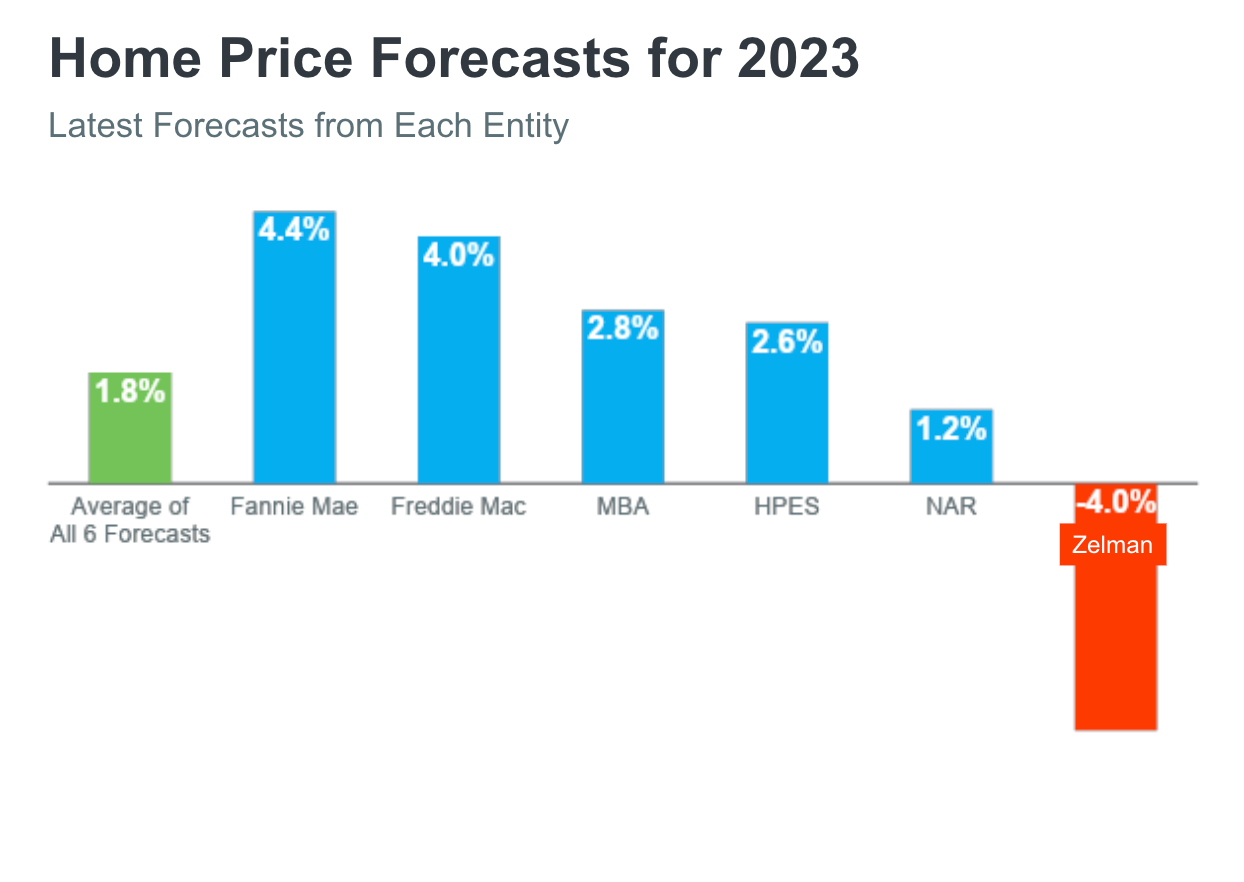

- The majority of industry experts are forecasting home prices to increase in 2023.

- You're probably sitting on a bunch of equity. Equity has risen in dramatic ways over the last couple of years.

So what does all of that tell us?

Right now, interest rates are higher than you'd like them to be, but that gives us softer buyer conditions if you need to buy a home when you sell yours. Even though the market has slowed, inventory levels are still under 2 months, which is very much a sellers market and about 1/3 of the homes sold last month went over asking price. This means there is still an opportunity for you to sell at a very good time.

With mortgage rates expected to come back down, you could purchase a home right now to capitalize on the softer market and refinance within the next year or two. Since home prices are still expected to appreciate, you should have that option.

On the other side of this, if you wait to sell, you could have higher demand for your home when interest rates come back down, but you also will likely be competing with more buyers when looking for the home you are going to buy. This could lead to you having to pay above asking price, losing negotiating power, etc.

In short, you can still make a very good case for selling your home right now and if that's right for you, we'd love to help.

Walter Ciucevich

919-750-0914